The Main Principles Of Estate Planning Attorney

The Main Principles Of Estate Planning Attorney

Blog Article

The Main Principles Of Estate Planning Attorney

Table of ContentsEstate Planning Attorney - QuestionsWhat Does Estate Planning Attorney Do?Facts About Estate Planning Attorney Revealed

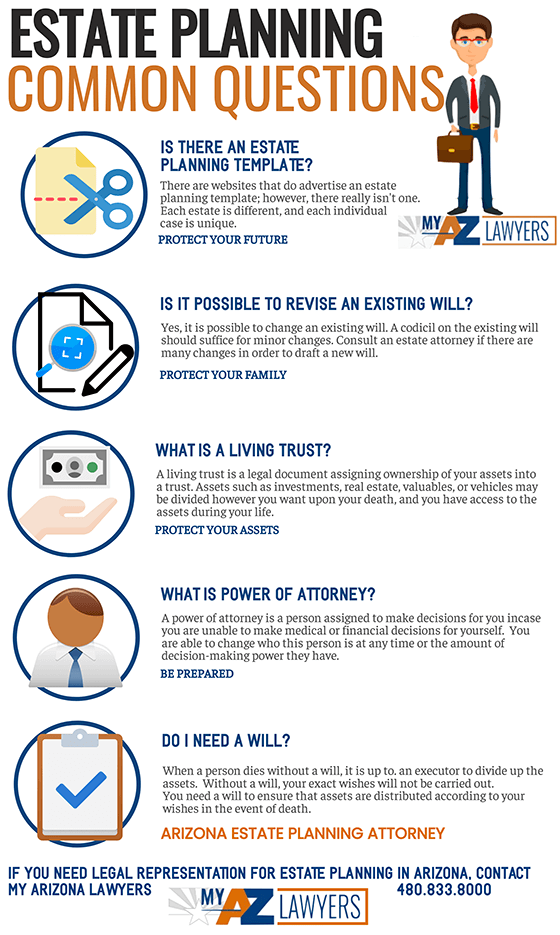

Modifications in your life can produce a reason to change your estate plan. Adjustments in the legislation can also produce a requirement to upgrade your estate plan. The various charges and expenses for an estate plan should be talked about with your lawyer. There are numerous sources for estate preparation used on the web or by various companies, and the reward to stay clear of attorneys' charges is usually a motivating factor.

It is likewise possible that it will be transformed as a result of the adjustment of management in 2020. The Illinois inheritance tax limit amount is $4,000,000 and an estate with even $1 over that quantity goes through tax on the entire quantity. A person whose estate surpasses these exception or limit levels requires to do some additional estate preparing to minimize or remove fatality taxes.

Nonetheless, the Illinois estate tax threshold is not mobile. Normally, a gift of building from a person to his/her spouse who is an U.S. resident is exempt to a gift tax obligation or an estate tax obligation. Presents to anybody else is a taxable present, but goes through a yearly exemption (reviewed below) and the very same life time exception as for government inheritance tax.

Some Known Facts About Estate Planning Attorney.

Some estate strategies may include lifetime gifts. In 2020, a person can surrender to $15,000 a year to any type of individual without a gift tax. In enhancement, under specific situations, a person could make gifts for medical expenditures and tuition expenditures over the $15,000 a year limit if the clinical settlements and tuition settlements were made directly to the medical supplier or the education service provider.

Each joint lessee, no matter of which one acquired or initially possessed the home, has the right to utilize the jointly owned property. When 2 individuals own home in joint occupancy and one of them dies, the survivor ends up being the 100 percent owner of that building and the departed joint tenant's interest ends (Estate Planning Attorney).

There is no right of survivorship with tenants-incommon. When a tenant-in-common passes away, his/her interest passes to his or her estate and not to the surviving co-tenant. The residential or commercial property passes, rather, as part of the estate to the successors, or the recipients under a will. Tenancy by the whole allows partners to hold their key residence free of cases against just one partner.

What Does Estate Planning Attorney Do?

Illinois has adopted a statute that allows financial accounts, such as with a brokerage firm, to be registered as transfer on fatality ("TOD"). These are similar to a payable on death account. At the fatality of the proprietor, the assets in the account are transferred to the marked beneficiary. Illinois has actually lately taken on a statute that enables certain property to be moved on death via a transfer on fatality tool.

The recipient of the transfer on death instrument has no interest in the actual estate till the death of the proprietor. All joint browse around these guys occupants have to concur to the sale or home mortgage of the building. Any kind of one joint renter might withdraw all or a part of the funds in a joint bank account.

Estate, gift, or income tax obligations may be impacted. Joint tenancy might have other repercussions. : (1) if residential property of any kind is held in joint tenancy with a loved one that gets welfare or various other benefits (such as social security advantages) this content the family member's entitlement to these advantages might be jeopardized; (2) if you place your home in joint tenancy, you may lose your right to useful elderly resident real estate tax treatment; and (3) if you develop a joint tenancy with a kid (or any person else) the youngster's financial institutions may seek to accumulate your child's financial debt from the building or from the profits of a judicial sale.

Joint occupancies are not an easy remedy to estate issues however can, in fact, create problems where none existed (Estate Planning Attorney). The expenses of preparing a go to this web-site will, tax obligation preparation, and probate may be of little importance contrasted with the unexpected troubles that can arise from utilizing joint occupancies indiscriminately. For a full description of the benefits and disadvantages of joint tenancy in your certain circumstance, you ought to speak with a legal representative

Report this page